Business Loans for Small Businesses

Business Loans for Small Businesses

Introduction & Overview of Business Loans for Small Businesses

Business Loans for Small Businesses: Running a small business often requires external financing to fund growth, cover operational expenses, or manage unexpected costs. Business loans for small businesses are a critical tool that allows owners to access capital without diluting ownership or waiting for revenue to accumulate. They provide the liquidity necessary to seize opportunities, expand operations, hire staff, or invest in technology and equipment.

Small business loans differ significantly from personal loans. Lenders assess the business’s ability to generate revenue, repay the loan, and manage cash flow effectively. Unlike venture capital, loans do not require giving up equity, which makes them attractive to founders who want to retain full control.

In 2026, small businesses have access to an unprecedented variety of lending options, ranging from traditional bank loans to online lenders and government-backed programs such as SBA loans. Each type of loan serves a distinct purpose, carries different costs, and requires varying qualifications. Understanding the nuances of each option allows business owners to make informed financing decisions, optimize their capital structure, and minimize financial risk.

This comprehensive guide aims to provide small business owners, entrepreneurs, and financial decision-makers with a complete roadmap for navigating the complex world of business financing. It covers the mechanics of small business loans, eligibility requirements, interest rates, repayment structures, and real-world case studies. Additionally, this guide addresses geographic considerations for local lenders, outlines best practices for lender selection, and explains how to match funding options with business goals.

By the end of this article, readers will gain actionable insights into how to evaluate, secure, and use business loans to grow their small business sustainably while avoiding common pitfalls. This article is written in international English and optimized to rank in Google, targeting both informational and commercial intent queries.

What Are Business Loans for Small Businesses?

Business loans for small businesses are short-term or long-term financing options specifically designed to meet the unique needs of small business operations. These loans can be used to fund a variety of purposes including working capital, equipment purchases, inventory acquisition, marketing campaigns, and expansion projects. Unlike personal loans, these loans are evaluated primarily based on the business’s ability to generate revenue and repay the debt, often with a secondary focus on the owner’s personal credit profile.

Small business loans can be structured in different ways:

- Term loans provide a lump sum upfront, repaid over a fixed period at either a fixed or variable interest rate.

- Lines of credit allow businesses to borrow as needed up to a certain limit, offering flexibility to manage cash flow fluctuations.

- Asset-based loans are secured by business assets such as equipment or receivables.

- Government-backed loans, such as SBA loans in the United States, offer lower rates and longer terms for eligible businesses.

The primary advantage of small business loans is that they provide predictable, structured capital without requiring business owners to give up equity or control. They allow entrepreneurs to leverage borrowed funds to achieve growth objectives and generate revenue that exceeds the cost of borrowing.

For lenders, small business loans are assessed on three main criteria:

- Creditworthiness of the business

- Revenue and cash flow stability

- Business plan and repayment strategy

By understanding the mechanics of these loans, business owners can make informed decisions that balance financial risk with growth opportunities.

How Business Loans for Small Businesses Work

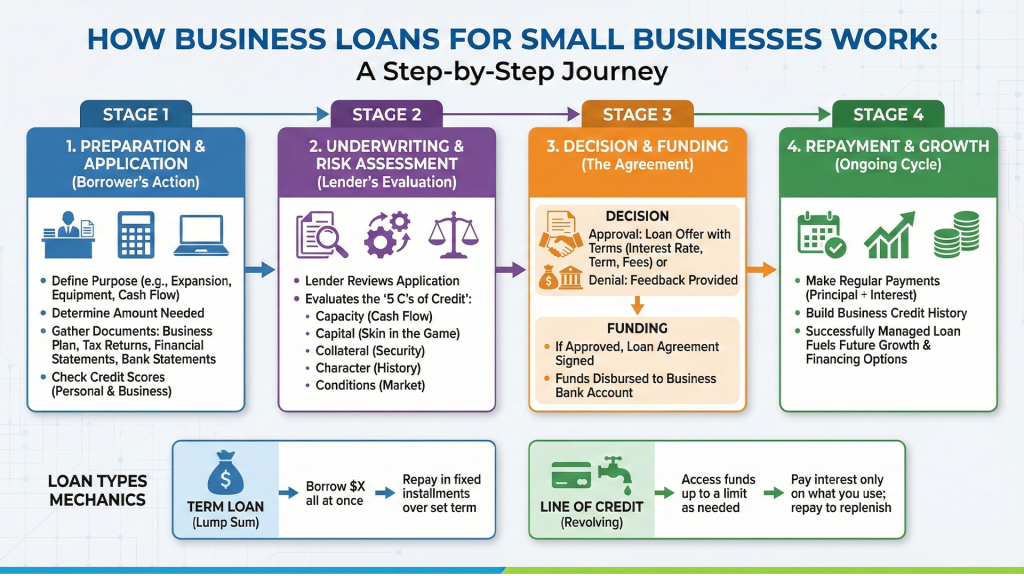

Small business loans function as agreements between the lender and the borrower, where the lender provides a specified amount of capital and the borrower agrees to repay it over a defined period with interest. The process generally involves several steps:

Identifying Funding Needs

Before applying, business owners must define the purpose and scope of the financing. This could include expanding operations, purchasing inventory, hiring staff, upgrading technology, or bridging cash flow gaps. Clearly identifying funding needs allows the borrower to select the most suitable type of loan and avoid overborrowing.

Choosing the Right Loan Type

Each business loan type has unique characteristics. Term loans provide upfront capital for significant investments but require regular fixed payments. Lines of credit are flexible and best suited for recurring or unpredictable expenses. SBA loans, while slower to approve, offer favorable interest rates and extended terms for eligible small businesses. Asset-based loans use business assets as collateral, reducing risk for lenders while providing access to higher capital amounts.

Application and Approval Process

The application typically requires documentation such as financial statements, tax returns, bank statements, business plans, and details about existing debt. Lenders assess the business’s creditworthiness, revenue consistency, and repayment capacity. Approval timelines can vary: traditional banks may take several weeks, whereas online lenders often approve loans within days.

Loan Disbursement and Repayment Structure

Once approved, funds are disbursed according to the loan agreement. Term loans usually provide a lump sum, whereas lines of credit allow incremental withdrawals. Repayment can be structured as fixed monthly payments, interest-only payments, or a combination of both. Understanding repayment obligations is crucial for maintaining cash flow and avoiding default.

Types of Business Loans for Small Businesses

Choosing the right type of business loan is critical to ensuring that your funding aligns with both short-term needs and long-term business goals. Different loans are structured to serve distinct purposes, and understanding the nuances of each can save you from high costs, unnecessary risk, and funding delays. This section explores the most popular and effective business loan types for small businesses in 2026.

Term Loans for Small Businesses

Term loans are one of the most traditional and widely used forms of business financing. They involve borrowing a fixed amount of money upfront and repaying it over a predetermined period with interest. Term loans can be short-term (generally under one year) or long-term (up to 10 years or more) depending on the lender and purpose.

Short-term loans are often used for immediate working capital, seasonal inventory needs, or urgent equipment purchases. Long-term loans are better suited for major investments such as property acquisition, business expansion, or technology upgrades.

Key characteristics of term loans include:

- Fixed or variable interest rates

- Structured repayment schedules (monthly, quarterly, or semi-annual)

- Predictable cost, allowing easy cash flow planning

The advantage of term loans lies in their simplicity and predictability. Businesses know exactly how much they owe and when repayment is due. However, term loans may require collateral, a strong credit profile, and evidence of consistent revenue to secure favorable rates.

Businesses that choose term loans benefit from stable financing costs, making it easier to forecast expenses. However, misalignment between loan term and project timeline can increase the effective cost if repayments start before revenue from the financed project materializes.

SBA Loans for Small Businesses

Small Business Administration (SBA) loans are government-backed loans that provide favorable terms for eligible small businesses. SBA loans are popular because they combine relatively low interest rates with longer repayment terms, making them more manageable than traditional bank loans.

Common SBA loan programs include:

- SBA 7(a) loans: Flexible financing for working capital, equipment, or expansion

- SBA 504 loans: Long-term, fixed-rate financing for major fixed assets like real estate

- SBA Microloans: Smaller loans for startups or businesses with limited credit history

SBA loans are highly structured, often requiring detailed business plans, financial statements, and extensive documentation. Approval timelines are longer than other loan types, ranging from several weeks to a few months. Despite this, the benefits—lower interest rates, longer terms, and partial government guarantees—make SBA loans a preferred option for many small business owners.

SBA loans are particularly suitable for startups and small businesses that need sizable capital but do not want to pay high interest rates or provide large cash reserves upfront. These loans also build credibility for the business, often easing future access to financing.

Business Lines of Credit

A business line of credit is a flexible financing solution that allows businesses to borrow funds up to a pre-approved limit. Unlike term loans, lines of credit work like a revolving credit account. Borrowers can withdraw, repay, and redraw as needed, which makes it ideal for managing cash flow fluctuations, seasonal expenses, or short-term funding gaps.

Key features include:

- Interest is charged only on the amount drawn

- Flexible repayment options

- Typically renewable annually

Lines of credit are particularly useful for businesses with variable revenue streams or unexpected expenses. They provide liquidity without the commitment of a fixed-term loan, allowing businesses to respond quickly to opportunities or emergencies.

The primary consideration is that interest rates may be variable, and some lenders require regular financial reporting. Responsible usage ensures that a line of credit supports growth rather than creating cyclical debt problems.

Equipment Financing Loans

Equipment financing loans are specialized loans designed to help businesses purchase or lease equipment without depleting cash reserves. The purchased equipment typically serves as collateral, reducing the lender’s risk and sometimes allowing higher borrowing amounts or better terms.

Advantages of equipment financing include:

- Preserves working capital

- Spreads the cost of equipment over time

- Often tax-deductible

These loans are ideal for businesses requiring machinery, vehicles, or technology essential to operations. Repayment terms vary based on equipment lifespan and depreciation schedules. Like other asset-based financing, approval can be faster because collateral reduces lender risk.

Invoice Financing and Factoring

Invoice financing or factoring allows businesses to access cash tied up in unpaid invoices. The lender advances a percentage of the invoice value, providing immediate liquidity while the lender collects payment from clients.

This method is particularly helpful for businesses with long payment cycles or B2B operations where clients may take 30–90 days to pay.

Key considerations:

- Fees or interest charged on the advanced amount

- Speeds up cash flow

- Does not increase long-term debt

Invoice financing helps maintain operations without waiting for customer payments and is ideal for businesses experiencing rapid growth or temporary cash flow crunches.

Merchant Cash Advances

A merchant cash advance (MCA) provides a lump sum upfront, repaid through a percentage of daily credit/debit card sales. While approval is fast and documentation minimal, MCAs come with high effective interest rates and can strain cash flow if sales decline.

Pros:

- Quick funding (often within days)

- No collateral required

- Flexible repayments linked to revenue

Cons:

- Extremely high cost compared to other loans

- Potential for cash flow issues

MCAs are generally recommended only for short-term emergency funding or businesses with strong, consistent daily sales.

Requirements, Rates, ROI, and Real-World Case Study

Accessing business loans for small businesses requires more than just an application. Lenders assess the business’s financial health, creditworthiness, and repayment capability to minimize risk. Understanding these requirements and the true cost of borrowing ensures you choose the right loan, manage repayments effectively, and maximize growth.

Requirements for Small Business Loans

Lenders have specific requirements, which vary depending on the type of loan and the lender’s risk appetite. However, several criteria are consistently evaluated across all small business financing options.

- Credit Score

A strong credit score—both personal and business—is often required. Banks typically prefer scores above 650, while alternative lenders may accept lower scores if other factors, like revenue and collateral, are strong. Your credit score influences interest rates, loan amounts, and approval speed. - Business Revenue and Cash Flow

Lenders want assurance that your business generates enough revenue to repay the loan. Monthly or annual revenue, profit margins, and cash flow statements are critical. Businesses with irregular income streams may need to demonstrate historical performance or provide guarantees. - Time in Business

Many lenders prefer businesses that have operated for at least 1–2 years. Startups may qualify for SBA microloans, lines of credit, or private lending, but terms may be more conservative. - Collateral and Personal Guarantees

Collateral reduces lender risk. This may include equipment, inventory, accounts receivable, or real estate. Some loans require a personal guarantee from the owner, making them personally liable if the business defaults. - Documentation

Required documentation includes financial statements, tax returns, business plans, bank statements, and existing debt details. SBA loans are particularly documentation-intensive, requiring detailed business plans and forecasts.

Meeting these requirements increases the likelihood of approval, lowers borrowing costs, and ensures the loan aligns with your business goals.

Business Loan Interest Rates, Fees, and True Cost

The cost of borrowing for small businesses varies significantly by loan type, lender, and risk profile.

Interest Rates

- Traditional bank loans: 5–10%

- SBA loans: 6–9%

- Online lenders / alternative financing: 8–20%

- Merchant cash advances: 20–60% effective APR

Fees

- Origination fees: 1–4% of the loan amount

- Application fees: $50–$500

- Prepayment penalties (sometimes applicable)

- Late payment fees

True Cost

Lenders also evaluate risk through fees and APR. Even if the interest rate appears low, hidden costs can increase the effective borrowing cost. Businesses must calculate total repayment including interest, fees, and operational holding costs to determine whether the loan is profitable.

ROI and Financial Impact

Borrowing can amplify growth, but mismanaged loans can quickly erode profits. ROI is calculated by evaluating revenue generated from the loan versus the total cost of borrowing.

Example ROI factors:

- Increased sales from expanded operations

- Cost savings from bulk inventory purchases

- Tax benefits from equipment financing or interest deductions

Proper financial modeling, scenario planning, and conservative assumptions help ensure the borrowed funds contribute positively to the business’s growth trajectory.

Real-World Case Study

Business Profile: Mid-sized retail business

Loan Type: SBA 7(a) Loan

Loan Amount: $150,000

Purpose: Expand inventory and hire additional staff

Term: 7 years, fixed interest rate 7%

Results:

- Increased monthly revenue by 30% within six months

- Hired 3 additional employees

- Loan repayments structured monthly, manageable within cash flow

- ROI: $45,000 net profit increase in the first year

This example demonstrates how structured financing, aligned with business goals, can create measurable growth and improve long-term sustainability.

Local Considerations, Lender Selection, Comparisons, FAQs, and Long-Term Strategy

Successfully accessing business loans for small businesses involves more than understanding loan types and rates. Geographic factors, lender relationships, risk assessment, and long-term financing strategy play a critical role in maximizing growth while minimizing costs and financial strain. This final section addresses these advanced considerations.

Small Business Loans Near Me

When searching for “small business loans near me,” geography matters. Lenders’ availability, interest rates, terms, and approval speed vary by city, state, and country. Local banks, credit unions, and community lenders often understand regional market dynamics better than national lenders.

Advantages of local lending:

- Faster loan processing and approvals due to proximity

- Knowledge of local business conditions and regulations

- Personalized support and relationship-based approvals

- Access to community-focused programs and grants

For example, small businesses in Texas or Florida may have access to multiple SBA-backed lenders with local expertise, while startups in New York or California may face stricter underwriting and higher costs due to higher operational and regulatory expenses. Entrepreneurs should evaluate the lender’s understanding of local market trends, including commercial real estate values, industry-specific risk, and economic cycles.

Local lenders also provide networking opportunities, often connecting business owners to mentors, regional development programs, and other resources that enhance long-term growth.

How to Choose the Best Lender for Small Business Loans

Selecting the right lender is crucial. The wrong lender can lead to high costs, inflexible repayment terms, and missed growth opportunities. Business owners should consider:

- Transparency – Clear disclosure of interest rates, fees, prepayment penalties, and repayment schedules.

- Speed – Ability to approve and fund loans quickly, especially in competitive or time-sensitive markets.

- Flexibility – Customizable draw schedules, repayment terms, and willingness to work through unforeseen issues.

- Reputation and Experience – Track record of supporting small businesses in your industry or region.

Before committing, ask questions such as:

- How is interest calculated and compounded?

- Are there early repayment or prepayment penalties?

- What collateral or personal guarantees are required?

- How quickly can funds be disbursed once approved?

Building a strong lender relationship can provide long-term benefits, including access to higher loan amounts, better rates, and flexible terms as your business grows.

Business Loans vs Alternative Financing

While traditional business loans are widely used, alternative financing options like merchant cash advances, invoice factoring, and online loans provide additional flexibility. Comparing options is critical to ensure the cost of borrowing aligns with cash flow and business goals.

| Feature | Traditional Loans | Alternative Financing |

| Interest | Lower | Higher (often 20–60% APR) |

| Approval Speed | Moderate | Fast (days) |

| Risk | Moderate | High |

| Documentation | Extensive | Minimal |

Businesses with predictable cash flows often benefit most from traditional loans, whereas businesses requiring immediate access to capital or with limited documentation may use alternative financing, keeping in mind the higher cost and risk.

Business Loans FAQs

Q1: Can startups qualify for small business loans?

Yes. While startups face stricter scrutiny, SBA microloans, online lenders, and private lending options allow eligible startups to access capital.

Q2: How much can a small business borrow?

Loan amounts vary widely, from $5,000 microloans to $500,000+ SBA term loans, depending on creditworthiness, business size, and lender policies.

Q3: How fast are business loans approved?

Traditional banks: 2–6 weeks, SBA loans: several weeks to months, online lenders: 1–7 days.

Q4: Are business loans risky?

Loans carry risk if cash flow is insufficient. Proper planning, conservative borrowing, and repayment discipline reduce risk significantly.

Q5: Can business loans be used for any purpose?

Most lenders restrict the use of funds to business-related expenses. Terms and allowable uses should always be confirmed.

Long-Term Small Business Financing Strategy

Accessing capital strategically allows businesses to scale responsibly and sustainably. Long-term strategies include:

- Recycling Capital – Using loan proceeds for growth and reinvesting profits to reduce reliance on debt.

- Building Credit – Timely repayment of loans strengthens business credit, unlocking better future financing.

- Diversifying Financing Sources – Combining SBA loans, term loans, lines of credit, and private funding reduces dependency on a single lender.

- Aligning Loans with Business Goals – Matching loan types and repayment structures to operational and expansion objectives minimizes financial strain.

The most successful small businesses treat borrowing as a growth tool rather than a short-term fix, ensuring that loans generate more value than they cost.

Final Verdict: Are Business Loans for Small Businesses Worth It?

Business loans for small businesses are a powerful tool for growth, expansion, and operational stability. When chosen wisely, with careful attention to lender selection, repayment planning, and cash flow management, these loans can accelerate revenue growth, create jobs, and enable long-term sustainability.

However, borrowing without planning or understanding loan terms can lead to financial stress, high costs, and reduced profitability. Successful borrowers focus on strategic alignment, conservative assumptions, and long-term relationships with reputable lenders.

For small business owners seeking capital without giving up equity, structured financing through the right loan can be both safe and highly effective. With disciplined management, business loans are not just a funding option—they are a strategic growth lever.